There are many IRS scams going on these days. It’s important to try and be alert when someone calls saying that they are from the IRS or either asking for your personal information. There are many ways as to how they might try to retrieve your information. Some might call and try to demand for your money right away and ask for your credit card details.

Before I proceed; a couple of things to remember. The IRS will never demand that you pay them immediately. They will also never ask for your credit card number or debit card directly over the phone. They also won’t threaten to call the local police or either other groups that might be related to the law.

Now, with all of that said check out these Top 10 IRS Scams

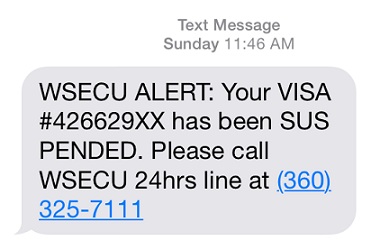

10. Text messages claiming to be the IRS

Some people have reported that they will receive text messages claiming that they are from the IRS. The message appears from a number that they don’t recognize. Sometimes it will include a link or either some kind of attachment for the person to open on their phone. If you receive a text message like this, simply do not reply to it. Never open up any of the attachments because they might have a virus on them which could infect your phone or computer. Never click on any of the links for this reason. If you have received such a text you can forward the text just like it is to: 202-552-1226.

9. Bogus IRS websites

When browsing the web you might discover websites which claim to be the IRS. However, the site is bogus and you know it. Maybe you’re unsure or just feel as if they could be asking for too much personal information. If you see a website that appears to be a bogus IRS website then report the URL of the website to: phishing@irs.gov and be sure that you put on the subject “suspicious website”.

8. They will demand that you wire money

If you receive either a phone call or email demanding that you wire them money or either pay them with a debit card, ignore it. Criminals tend to try and push that you use you give your debit card information or either transfer them money right away. The sad part about this one is, when you’ve done the transaction or sent your money you more than likely won’t get it back. These types of money transactions can be extremely difficult to trace once they are completed. You will need to contact your local bank and possibly change your credit card information depending on how you sent them the money.

7. One IRS scam involves them calling or emailing people about stocks

You could receive a telephone call that’s unsolicited or either emails that involve stocks or possibly share purchases. You’ll need to report the email to phishing@irs.gov and put on the subject “stock”. They might also try to get you with saying that you have penalties or that advanced fees might be needed for your taxes. If you’ve been a victim of stock IRS scams then you’ll need to file a FTC Complaint Assistant.

6. They might try to bully or rush you into a decision

If you’ve received emails or phone calls that will try to force you into making a decision fast, ignore them and report it. They will try to pressure you in any way that they possibly can and get you before you’ve even had time to think properly about it. Do not act right away whenever you’ve received any kind of phone message, call, text or email that says they will call the police, shut off your utilities or threaten you in some other way. Depending on what happened, you will need to either report their phone number or emails.

5. Fax or mail IRS Scams

You might receive a letter in the mail or either a fax claiming that they are from the IRS when it’s from an individual. They might demand in the fax or email that you pay them instantly. They could also even provide a phone number for you to call and make your payments. When this happens or you possibly suspect that the fax or letter is false then check out the IRS Home Page. Search the form number, notice or either letter. When in doubt, call 1-800-829-1040 and check to see if it’s legit or a scam.

4. Fake 1-800 IRS Numbers

You might have a phone number that shows up as a 1-800 number and it could possibly look legit from the number. They might also claim that they are from the IRS and sound extremely professional. Again, they might also ask for your debit information or possible other information. Whenever you’ve received a phone call that’s a 1-800 number and you’re unsure call 1-800-366-4484 to confirm if the phone number is legit or fake. If you do find out its fake then report the incident directly to the TIGTA.

3. Beware of emails or text messages that might contain typos

Whenever you’ve received any kind of email or text message that contains typos, bad grammar or either wording that might have phrasing in it that’s strange then know be cautious. This should send a red flag to you immediately. Scammers can even steal a copy of the government seal but the email or letter contains wording that’s awkward or either the grammar is poor. The IRS would never send out letters with a lot of typos or strange phrasing in it. This is another incident where you’ll need to check out the IRS home page and find out if it’s a scam.

2. Email you demanding that you pay immediately

You might receive emails demanding that you pay them immediately. They could get rude and threaten you with the payment. They might sound professional in the first email. When you reply to it is when they might threaten that you or sometimes they might even demand that you pay them in the first email. Just remember, the IRS will never email you and demand that you pay them right away. Report the email if you’ve received one. Do not respond to it.

1. Use Other Spoof Numbers Besides The 1-800 Number

One of the most common ways people will try to scam others is with using a spoof number that might not even be a 1-800 number. It could be a number that looks local or even it could appear as if it’s a bank number, credit card company, government agency or the local police government or other law enforcement company. If you’ve received a fake IRS number phone call then first, research Google and type in the phone number. Report the number after you’ve discovered that it’s fake.

Conclusion

Whenever you feel that it’s a scam or fake, don’t be fooled into responding right away. Take the time out and research the email or phone number. Always report the number even if you did not respond to it.